Macquarie Bank joins cashless society push

The logo says all you need to know: Photo: ANH

MAQUARIE CHANGES

Macquarie Bank, named after Australia’s first Freemason Governor Lachlan Macquarie, has announced it will phase out its cash, cheque and phone payments for customers from next year.

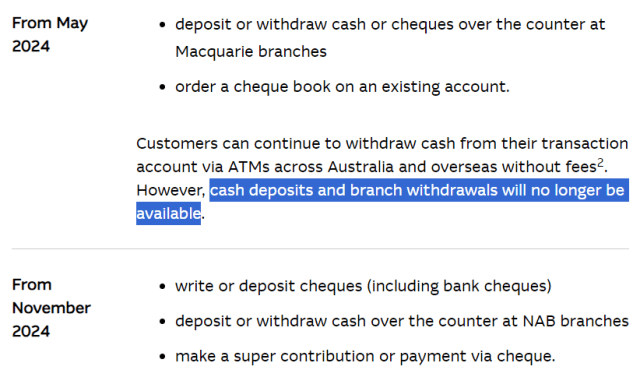

In a letter policy notice update, Macquarie Bank says that by November 2024, customers will be unable to write or deposit cheques (including bank cheques), deposit or withdraw cash over the counter branches, or make a super contribution or payment with a cheque.

The changes will be rolled out in stages over the coming year, beginning in January 2024, where Macquarie Bank customers will not be able to order a new cheque book.

Macquarie Bank’s telephone banking system is set to follow, being axed in March of next year.

Then, customers will also be no longer able to deposit or withdraw cash or cheques over the counter at Macquarie branches from May 2024:

As Macquarie Bank is also ending its partnership with NAB, by November 2024, these changes will also apply to those looking to do the same in their branches.

“As a digital bank, we’re committed to transitioning to completely digital payments by November 2024 as a safer, faster and convenient way to bank,” a Macquarie Bank spokesperson reporters.

“The majority of our customers already bank digitally and we’re working very closely to support the less than 1 percent of our customers who currently use cheques or cash to ensure they have access to other digital payment methods.”

Yes, the engineered societal push towards ‘convenience’ is always used as the justification for this transition, when most simply have not stopped to think about just what this type of future holds.

It was a slow-building process, piece by piece, that snuck under the radar. From cards that had to be inserted, to a little chip in them that saves you the effort, to now digital methods bypassing cards.

Carefully crafted by the puppet masters who understand how the human herd functions mentally.

‘But the marketplace and the people chose this’.

Most understand the hacking risks, but if they also understood transaction fees, digital platform fees, and most importantly, how your life and habits can be tracked-and-traced, maybe it would be different.

But now, all of a sudden, it might be getting too late, as the shift away from physical money towards a centralised identity-backed tracking value system is right around the corner.

Macquarie joins Commonwealth Bank in the shift towards a cashless society, and more may soon come.

In July, it was announced that cash is no longer available over the counter at a number of Commonwealth Bank locations, with Specialist Centres to focus on “more complex banking needs”.

The changes come after Federal Treasurer Jim Chalmers also announced in June that cheques will be phased out nationwide by 2030 in a federal government shake-up of Australia’s payments system.

With 2024 fast approaching, it seems they are pushing ahead with forecasted timelines in 2021 (during lockdowns) that stated Australia will become “effectively cashless’ by that year.

Let’s not forget that lockdowns themselves helped push this agenda over the final hurdles with record online sales and a switch-of-shopping-culture to apps like Uber Eats and Menulog.

But it is not only at the cashless point where they intent to stop with this vision.

The removal of cash is just a large piece in an even bigger puzzle that will slowly emerge soon to follow.

Bank branches themselves are becoming a thing of the past, disappearing at “alarming” rates, and in the future, each branch will only have one obscure branch 400km away you can visit if you want cash.

‘See, we didn’t ban it!’

The ‘Big 4’ banks in Australia are already following in suit with the Reserve Bank’s push to soon introduce Central Bank Digital Currencies, with pilots currently being tested in the industry.

Underpinning all of this will be digital identity checking services to keep your new virtual-only CBDC transactions ‘secure’, because you know, you can trust that it won’t be hacked or tracked.

This is the roadmap of the elitist parasites if they have their way, but perhaps, it is not all finished just yet.

We have recently spoken about resurgences in cash uses, as business complain about how much they are losing through online and digital methods, while test cases around the world show us it won’t feasibly be able to be completely achieved until the non-internet generation is gone.

Raise these points with your friends and family, with your employer, with the service station owner down the road. Privacy, tyranny, all great talking points that everyone can understand. Spread the word.

I believe perhaps we may even be at the point that ‘stop cashless society’ rallies are needed just to bring attention to such an important issue; one that the average citizen doesn’t think twice about.

And, in the end, if we do end up ‘going down the toilet’, we can always take on the vibe of this legend:

As always, TOTT News will be following the latest developments through this financial transition.

Source: https://tottnews.com/2023/09/24/macquarie-bank-cashless-2024/